Frequently Asked Questions (FAQs)

- Fines, Interest and Penalties

- Insurance

- General Information

- Tax Filings and Payment

- Compliance and Collections

- Objections and Appeals

- Payment of Taxes and Licenses

- Tax Assessments

- Tax Applications

- Online Services

Do I have to pay taxes that are years overdue?

How do I avoid penalties and interest charges on taxes and licences?

How do I avoid the penalties and interest charges?

BUSINESS AND OCCUPATION LICENCE

What is the late payment interest rate for Business & Occupation Licence?

What is the late payment penalty for Business and Occupation Licence ?

CORPORATE INCOME TAX

What are some of the penalties for corporate income tax?

• Penalty of 10% of the amount tax owing.

• $100 per month or part thereof during which failure to file continues.

• $1000 per month or part thereof during which failure to file continues by a person who is exempt from the payment of any tax.

• Underpayment of tax as a result of an incorrect statement or material omission in the taxpayer’s return attracts a penalty of 25% of the sum underreported.

• Any person who knowingly makes false statement or false representation, concerning income on which tax is payable, commits an offence and is liable to a fine not exceeding $50,000 or imprisonment with or without hard labor for a term exceeding 12 months.

What are the late filing and payment penalties for Corporate Income Tax ?

What is the late payment interest rate for Corporate Income Tax.

HOTEL & RESTAURANT TAX

What is the late payment interest rate for Hotel Accommodations & Restaurant Tax ?

What are the late filing and payment penalties for Hotel Accommodations and Restaurant Tax ?

ISLAND ENHANCEMENT FUND (E-FUND)

What are the late filing and payment penalties for Island Enhancement Fund ?

What is the late payment interest rate for the Island Enhancement Fund ?

PROPERTY TAX

What is the penalty for Property Tax ?

What is the late payment interest rate for Property Tax ?

UNINCORPORATED BUSINESS TAX (UBT)

What is the late payment interest rate for the Unincorporated Business Tax ?

What are the late filing and payment penalties for the Unincorporated Business Tax ?

VALUE ADDED TAX (VAT)

What are the late filing and payment penalties for Value Added Tax ?

What is the penalty for submitting a false tax invoice for the purposes of the Value Added Tax (VAT) ?

What are the penalties for the Value Added Tax for failing to apply for registration and not displaying my VAT certificate?

Subsection (1) - A person who fails to apply for registration as required by subsections (4),(6), (9), (11), and (13) of section 2 shall be liable to pay a civil penalty equal to double the amount of output tax payable from the time the person is required to apply for registration until the person files an application for registration with the Comptroller.

Subsection (2) - A person who fails to display the certificate of registration issued by the Comptroller as required by section 20 shall be liable to pay a civil penalty of $50 per day in respect of each day or portion thereof that the failure continues.

What are the general penalties for Value Added Tax (VAT) ?

What is the penalty for failing to comply with a notice for recovery of tax for Value Added Tax ?

What is the late payment interest rate for Value Added Tax

What is the late filing penalty for Value Added Tax ?

What is the penalty for failing to provide an Inland Revenue Department Officer with facilities for examination under the Value Added Tax?

What is the penalty for failing to comply with a notice under section 81 (Notice to obtain information or evidence) for the Value Added Tax?

What is the penalty for making a false or misleading statement under the Value Added Tax Act.

What is the penalty for failing to keep records for Value Added Tax ?

WITHHOLDING TAX

What is the late payment interest rate for Withholding Tax ?

What is the late payment penalty for Withholding Tax ?

Are insurance companies required to declare the fee to the customer ?

“Every insurer shall pay to the Accountant General a registration fee of two dollars for every one thousand dollars worth of insurance up to a maximum registration fee of thirty dollars per policy in respect of any insurance policy issued or applicable in Saint Christopher and Nevis.”

Will a change in the policy affect the registration fee ?

Once the endorsement does not result in a change in the value of the policy, the registration fee would not be changed. However, on renewal of policies the registration fee is applicable.

How is fee to be described on the invoice?

Kindly refer to the Insurance Act Cap 21.11 section 228 (3) which states

“Every insurer shall pay to the Accountant General a registration fee of two dollars for every one thousand dollars worth of insurance up to a maximum registration fee of thirty dollars per policy in respect of any insurance policy issued or applicable in Saint Christopher and Nevis.”

Is the fee based on payments received or billings?

The insurance registration fee is based on the value of the policy issued.

Is the registration fee to be paid upfront or when payments are received ?

The insurance registration fee is paid to the Department in the period in which the policy was issued. For example, policies issued in October 2019 would be reported on the tax return covering the period 01 September – 30 November 2019 due December 16, 2019.

If after the payment of the registration fee, a policy is cancelled (for example non-payment; sale of motor vehicle). Is it that on cancellation there will be a refund ?

No, the insurance registration fee is not refundable on cancelled polices.

What are the instructions where there is no sum insured (e.g. Motor Third Party Policies)?

For third party policies that do not carry a policy value , the registration fee will be paid on the maximum liability the insurer will cover on the third party policy.

How is the fee calculated?

Example: The sum insured is $14,600 (14.6). The correct calculation of the tax: 14 x $2.00 = $28.00. The registration fee for sum insured of $14,600 is 28.00.

What is the registration fee payable on? Premium income or sum insured.

The fee is payable on the sum insured (Value of policy).

Third party policies do not have a sum insured. What is the registration fee paid on?

For third party policies that do not carry a policy value, the registration fee will be paid on the maximum liability the insurer will cover on the third party policy.

If insurance companies were to pay the registration fee for our third party policies on amount of our liability this will not be consistent with our comprehensive policies.

For comprehensive policies which carry a value, the registration fee would be payable on the policy value (sum insured).

Will this registration fee be payable only on new policies or all existing policies as well?

This fee is payable on any new policy and on any renewal of a policy. Section 22 of the

Insurance Act states:

(22) Effect of cancellation of registration

(2) For the purpose of subsection (1), an insurance company shall be treated as having entered into a new policy if a policy entered into prior to the date of the notification under section 23 is renewed or varied after that date.

Is the Two Dollars ($2.00) per Thousand Insurance Registration Fee to be paid on Policy Premiums or Policy Values?

The registration fee is paid on the value of the policy.

If Policy Values, kindly state how the Third Party Insurance Registration Fees are to be determined as Third Party Policies do not carry any values.

For third party policies that do not carry a policy value, the registration fee will be paid on the maximum liability the insurer will cover on the third-party policy.

WHAT ARE THE HOURS OF OPERATION AT INLAND REVENUE DEPARTMENT?

By registering to use the Inland Revenue Department's e-Services, you can file your tax returns and or make payments at any time and from any location.

How long does it take before I am issued a Tax Clearance Certificate?

Taxpayers are encouraged to ensure they are up to date with their tax filings and payments to avoid any delays in the issuance of their Tax Clearance Certificate. Certificates are only issued if all tax filings and payments have been made, or arrangements have been made to complete the filings and payments.

How do I get a Tax Clearance Certificate?

Who needs to file a tax return?

What are the benefits derived from paying taxes?

WHAT PROCESS MUST I FOLLOW TO ENSURE I USE MY TIME WISELY AT INLAND REVENUE DEPARTMENT?

Taxpayers should first visit the customer service desk to make enquiries, verify outstanding amounts or obtain tax payment forms. Your next step is the cashier’s station to make payment.

WHAT ARE THE MODES OF PAYMENT FOR TAXES AND LICENSES?

Cash

Cheques (payable to Accountant General and from individuals or companies in good standing)

Credit or Debit cards (Visa /Master card only)

Money Orders

Wire Transfers

WHEN DO TAXES BECOME DUE AND PAYABLE?

Payments are due monthly, quarterly and annually depending on the type of tax. For ease of reference please sees our Tax Calendar located on our website, www.sknird.com.

DO I HAVE TO PAY TAXES THAT ARE YEARS OVERDUE?

Overdue taxes increase over time due to fines, penalties and interest for non-payment. No matter how much time has passed, you are still responsible for any tax liability incurred by you or your business. It is advisable to pay your taxes immediately or make arrangements with Inland Revenue to pay over a short time period.

IF MY BUSINESS CLOSES AM I STILL RESPONSIBLE FOR THE TAXES?

Yes, once the tax debt was incurred while the business was still operating you are responsible for payment. Overdue taxes increase over time due to fines, penalties and interest for non-payment. No matter how much time has passed, you are still responsible for any tax liability incurred by you or your business. It is advisable to pay your taxes immediately or make arrangements with Inland Revenue to pay over a short time period.

WHAT HAPPENS TO TAXES OWED WHEN A TAXPAYER IS DECEASED?

IF A TAXPAYER LOSES PART OF, OR HIS ENTIRE BUSINESS, DUE TO A NATURAL DISASTER, IS THE TAXPAYER ALLOWED A GRACE PERIOD TO PAY HIS TAXES?

The Department empathizes with situations such as these, however, taxpayers in these circumstances should contact the Inland Revenue Department immediately. An officer will assist you in making the appropriate arrangements for filing and payment of taxes.

WHAT HAPPENS IF A TAXPAYER DOES NOT HONOR HIS PAYMENT AGREEMENT?

Breech in payment agreements, results in the Department recovering the tax using the recovery methods outlined in Part VI of the Tax Administration and Procedures CAP 20.52.

DOES THE INLAND REVENUE DEPARTMENT ACCEPT PARTIAL PAYMENT FROM TAXPAYERS?

Payment Agreements which are not honored, results in the Inland Revenue Department recovering the full tax using the recovery methods outlined in Part VI of the Tax Administration and Procedures CAP 20.52.

BUSINESS AND OCCUPATION LICENCE

Where can I find the costs associated with different types of Business Licences ?

DRIVER LICENCE

Can I wear white when taking my photo for my drivers’ licence?

What is the cost to renew my drivers’ licence?

Can my Driver Licence be renewed for five (5) years.

If I renew my Drivers' Licence online, how will I receive my Driver Licence card?

INSURANCE FEES

How is the Insurance Registration Fee to be described on the invoice?

Is the Insurance Registration Fee based on payments received or billings?

When is the Insurance Registration Fee to be paid to Inland Revenue Department?

If after the payment of the Registration Fee, a policy is cancelled (example: non-payment; sale of motor vehicle). Will there be a refund?

What is the Insurance Registration Fee charged on where there is no set insured sum. (e.g. Motor vehicle Third Party Policies)?

How is the Insurance Registration Fee calculated?

Example: The sum insured is $14,600 (14.6). The correct calculation of the tax: 14 x $2.00 = $28.00. The registration fee for sum insured of $14,600 is 28.00.

“Every insurer shall pay to the Accountant General a registration fee of two dollars for every one thousand dollars worth of insurance up to a maximum registration fee of thirty dollars per policy in respect of any insurance policy issued or applicable in Saint Christopher and Nevis.”

Will a change in the policy affect the Insurance Registration Fee?

VEHICLE LICENCE (WHEEL TAX)

What is the cost to renew my vehicle licence?

FILING REQUIREMENTS

WHO NEEDS TO FILE A TAX RETURN?

WHAT HAPPENS WHEN A TAXPAYER FAILS TO FILE?

If you fail to file when required, the Comptroller shall make an estimated assessment to determine the amount of tax payable.

In the case where the Comptroller has made an assessment to determine the amount of tax payable, he/his designate may enter your place of business and demand the amount of tax outstanding. Failure to comply with the request for payment may result in court action.

DO I STILL NEED TO FILE A TAX RETURN IF I DID NOT CONDUCT ANY BUSINESS FOR A PARTICULAR TAX PERIOD?

Yes, every taxpayer shall file a tax return for each tax period with the Comptroller after the end of the tax period, whether or not tax is payable.

CAN I FILE AN AMENDED TAX RETURN IF THERE WAS AN ERROR?

Yes, a taxpayer may file an amended tax return no later than six years after the due date on which the original tax return was required to be file. The Comptroller may re-assess the taxpayer’s liability if he is satisfied that the previous assessment was incorrect.

WHO IS A NON-FILER AND WHO IS A STOP-FILER?

A non-filer is a taxpayer who fails to voluntarily file a tax return and pay his/her taxes as required by law.

A Stop Filers are taxpayers/assesses who have discontinued filing returns. These were previously voluntary filers but for whatever reason have stopped submitting their returns as required by law.

WHAT IS A SELF-ASSESSMENT?

A self-assessment occurs when the taxpayer calculates his/her tax liability, files the tax return and pays the applicable taxes. Be aware that these tax liabilities may be reassessed by the Comptroller if there is sufficient reason to do so.

WHAT IS A BEST-OF-JUDGMENT ASSESSMENT?

CAN I OBJECT TO A BEST JUDGMENT ASSESSMENT?

After receiving a Best Judgment Assessment Notice or Any Notice of Assessment from the Inland Revenue Department, the taxpayer has 30 days in which to object. This objection must be in writing to the Comptroller of Inland Revenue. It is noteworthy that when filing an objection, you should provide documentation and the completed Tax Return Form for the period you are objecting, in order to validate your claim

WHAT IS A REASSESSMENT?

A reassessment occurs when the taxpayer has filed his return and the Inland Revenue Department’s examination and computation of the tax liability, reveals an underassessment, overassessment or filing error which will lead to a reassessment of the tax liability. This may also be initiated as a result of an audit, an appeal or court action where the tax liability requires amendment based on a ruling.

CORPORATE INCOME TAX

WHO IS LIABLE FOR CORPORATE INCOME TAX?

WHEN IS THE TAX RETURN DUE?

Companies are required to file 3 1/2 months after the end of their fiscal year. Filing is based on the regular periods, which normally runs from 1st January to 31st December. Companies desirous of using a different reporting period commencing any month outside of January and concluding 12 months after, must request permission from the Comptroller of Inland Revenue.

CAN AN EXTENSION TO FILE BE GRANTED?

WHAT HAPPENS IF A COMPANY FAILS TO FILE A RETURN?

If a taxpayer fails to file a return as required, the Comptroller has the authority to make an assessment based on whatever relevant information may be available at that time or to make an assessment to the best of the Comptroller’s judgment. As long as the return remains unfiled, the Comptroller can indefinitely reassess the ‘best judgment assessment’, as many times, as new information is discovered. Remember there are penalties if a company does not file on time.

WHAT IS AN INCOME TAX INSTALLMENT?

An installment is a prepayment of taxes. An installment for income tax is an amount equal to one quarter of the tax as estimated by the taxpayer at the rate of 33% on their chargeable income for that year.

WHEN ARE INSTALLMENTS DUE FOR INCOME TAX?

Generally, taxpayers are required to pay their Corporate Income tax in installments. Installments are due on the 15th day of each calendar year quarter.

March 15th

June 15th

Sept 15th

Dec 15th

Section 44 (6) of the Income Tax Act Amendment Act No. 6 of 2006 states;, any balance owing on a Corporate Income Tax Return is due on the filing deadline of the return. If payment is received after that date, interest will be charged commencing on the filing deadline and will be charged up until the amount owing has been fully paid.

WHAT ARE SOME OF THE PENALTIES FOR CORPORATE INCOME TAX?

Any person who fails to file a return on or before the date on which filing is due, is liable for:

• Penalty of 10% of the amount tax owing.

• $100 per month or part thereof during which failure to file continues.

• $1000 per month or part thereof during which failure to file continues by a person who is exempt from the payment of any tax.

• Underpayment of tax as a result of an incorrect statement or material omission in the taxpayer’s return attracts a penalty of 25% of the sum underreported.

• Any person who knowingly makes false statement or false representation, concerning income on which tax is payable, commits an offence and is liable to a fine not exceeding $50,000 or imprisonment with or without hard labor for a term exceeding 12 months.

WHAT MUST BE SUBMITTED WHEN FILING CORPORATE INCOME TAX?

• Returns must be accompanied by the company’s

• Financial Statements

• Statement of Financial Position (Balance Sheet)

• Statement of Comprehensive Income (Profit and Loss)

• Cash Flow Statement

• Statement of Retained Earnings

• Notes and Disclosures to Financial Statement

WHAT RECORDS SHOULD BE KEPT AND FOR HOW LONG?

Taxpayers are required to keep all documents and records to support the Corporate Income Tax Returns filed for a minimum of six years after the date on which the original tax return was required to be filed.

WHO CAN BE AUDITED?

Any corporation which was incorporated in St. Kitts and Nevis or individual operating a business can be audited by the Inland Revenue Department.

WHAT KIND OF ACCOUNTING SYSTEM SHOULD I USE?

Taxpayers are required by law to keep in the English language a proper set of books of accounts. There are many systems available that will meet the book of accounts standards required by the tax legislation, both computerized and manual.

DO FINANCIAL STATEMENTS HAVE TO AUDITED?

Taxpayers are required to file Audited Financial Statements using IFRS or other recognized GAAP requirements for submissions to the Inland Revenue Department. These financial statements must be compiled by an independent third party. The Inland Revenue Department will also accept compilations and reviews that are performed using IFRS and other recognized GAAP requirements by an independent third party.

DRIVER’S LICENCE

WHAT IS THE COST TO RENEW DRIVER’S LICENCE?

The Drivers’ licence Fees payable are as follows;

| LICENCE TYPE | LICENCE FEE |

| Learners Permit | $62.50 |

| First Licence | $162.50 |

| Licence Renewal (3 Year Licence) | $187.50 |

| Instructors Licence | $62.50 |

| Lost/Stolen/Misplaced | $75.00 |

| Upgrade Licence | $68.75 |

| Temporary Licence | 3 months – $62.50 or 1 year – $125.00 |

WHEN WILL MY DRIVER LICENCE EXPIRE?

All Drivers’ Licence issued by the Inland Revenue Department has a maximum duration of 3 years. Each license is set to expire the day before the holders’ birthday.

IS THERE A LATE FEE FOR NOT RENEWING YOUR DRIVER’S LICENCE AFTER IT EXPIRES?

CAN I RENEW MY ST. KITTS AND NEVIS DRIVERS’ LICENCE WHILE ABROAD?

Yes, the procedure below gives details as to the entire process. Click the link below: here

MOTOR VEHICLE LICENCE

WHAT IS THE COST TO LICENCE OR RENEW MY VEHICLE?

| WEIGHT/LBS | 1 YEAR | 3/4 YEAR | 1/2 YEAR | 1/4 YEAR |

| Motor Cycle | $186.00 | $139.50 | $93.00 | $46.50 |

| Motor Cycle (with side) | $218.00 | $163.50 | $190.00 | $54.50 |

| Motor Vehicles – 1120 | $287.00 | $215.25 | $143.50 | $71.50 |

| 1121-2240 | $325.00 | $243.75 | $162.50 | $81.25 |

| 2241-4480 | $362.00 | $271.50 | $181.00 | $90.50 |

| 4481-6720 | $400.00 | $300.00 | $200.00 | $100.00 |

| 6721-7840 | $431.00 | $323.25 | $215.50 | $107.75 |

| 7841-8960 | $468.00 | $351.00 | $234.00 | $117.00 |

| 8961-100800 | $500.00 | $375.00 | $250.00 | $125.00 |

| 10081-11200 | $575.00 | $391.25 | $287.50 | $143.75 |

| 11201-12320 (Plus $2500) | $593.00 | $444.75 | $296.50 | $148.75 |

| 12321-13440 (Plus $2500) | $687.00 | $515.25 | $343.50 | $171.50 |

| 13441 & Over (Plus $2500) | $1100.00 | $825.00 | $550.00 | $275.00 |

| Trailers under 2240 | $150.00 | $112.50 | $75.00 | $37.50 |

| Trailers over 2240 | $250.00 | $187.50 | $125.00 | $62.50 |

| All vehicles must be licence upon purchase before the owner drives the vehicle.* | ||||

ARE THERE FEES FOR LATE PAYMENT OF WHEEL?

There is a 1% interest charge if you renew after its expiry date.

PROPERTY TAX

WHEN IS MY PROPERTY TAX DUE?

WHAT IS THE RATE OF TAX APPLIED TO PROPERTIES?

The Property Tax Act Cap 20.32 states that each property must be categorized in at least one valuation class in accordance with the property’s use. The table below shows the five different valuation classes and the applicable tax rate.

| VALUATION CLASS | RATE APPLICABLE |

| Residential | 0.002% |

| Commercial | 0.003% |

| Accommodation | 0.003% |

| Institutional | 0.00% |

| Agriculture | 0.00% |

HOW IS PROPERTY TAX CALCULATED?

Example of calculation of tax on a residential property with market value $140,000.00 (building value $120,000 and land value $20,000)

| Building Value | $120,000.00 |

| Exemption | – $80,000.00 |

| Taxable building value | $40,000.00 |

| x 0.002% | |

| Tax on building | $80.00 |

| Land value | $20,000.00 |

| x 0.002% | |

| Tax on land | $40.00 |

| Tax on building | $80.00 |

| Tax on land | $40.00 |

| Tax Due | $120.00 |

WHAT ARE THE PENALTIES AND INTEREST CHARGES ASSOCIATED WITH PROPERTY TAX?

The charges are as follows: 1% per month or 12% per annum .

WHAT HAPPENS IF I DO NOT PAY MY PROPERTY TAX?

Where taxpayers default on paying their property tax, the Comptroller reserves the right to prepare a certificate confirming the default and send it to the Provost Marshall where the remedy may be either sale by public auction of the property itself or part thereof or seizure and sale of goods and chattels of the owner.

I owe taxes and cannot afford to pay the balance at once, can the Department facilitate me?

When does collection enforcement action begin?

Collection enforcement action begins when a taxpayer fails to file their tax returns and fails to pay their taxes on or before the due dates.

What happens when you fail to voluntarily pay your taxes?

• Request payment in full from taxpayers, taxpayer’s agent or executor of an estate.

• Negotiate collections payment arrangement plan.

• Set off taxes with income from other government departments.

• Issue third party demands notices, i.e. request payment from any person or institution that owes you money Place crown liens on taxpayers’ property.

• Liens are claims for tax debt that may be placed on the title of a property that must be paid when the property is sold.

• Enforce liens created on every tax debt at the time of assessment.

• Issue an intention to levy execution and a levy of execution (garnishee order) against taxpayer’s property.

NOTE: The intention to levy execution allows the Inland Revenue Department to inform a tax debtor of the Department’s intention to seize his/her bank account, receivables and or wages. The tax debtor is given at least thirty days to contact the Department before any action is taken regarding his/her property. Once the thirty days has passed and the taxpayer has failed to contact Department, an execution levy would be warranted.

Assets equivalent to the owing tax All Seize and sell goods and property that are not personal effects, furnishings and tools used in taxpayer’s trade, collect payment as a civil debt in court.

What is an intention to levy execution?

What happens to taxes owed to the Inland Revenue Department when a taxpayer is deceased?

Any asset owned by the deceased person, in whole or in part, shall be used to recover the applicable taxes. If the deceased person has multiple creditors the Inland Revenue Department has the right to claim these assets before any other creditor.

If my business closes am i still responsible for the taxes?

Yes, once the tax debt was incurred while the business was still operating you are responsible for payment. Overdue taxes increase over time due to penalties and interest from non-payment. No matter how much time has passed, you are still responsible for any tax liability incurred by you or your business. It is advisable to pay your taxes immediately or make arrangements with Inland Revenue to pay over a short time period.

What happens if a taxpayer does not honor his payment agreement?

Breaking a payment agreement arrangement, results in the Inland Revenue Department recovering the tax using the recovery methods outlined in Part VI of the Tax Administration and Procedures CAP 20.52.

What is a debt management and compliance officer?

The Debt Management and Compliance Officer assists taxpayers who are (1) in arrears or (2) have not filed the mandatory tax returns. These officers engage taxpayers on a personal level to assist them to become and maintain a good tax compliance status.

How do I file a Notice of Objection?

An Objection can be filed by completing a Notice of Objection form or by writing a letter to the Comptroller of the Inland Revenue Department. The form must be signed by the taxpayer, the owner of the business or an authorized employee of the company. If a representative is appointed, the taxpayer must provide written authorization. A Notice of Objection may be sent by regular mail or facsimile transmission, or may be hand delivered to the Inland Revenue Department, Bay Road, Basseterre – Objections and Appeals section.

OBJ-001: Objection Form For Tax Assessments: To be used for all tax objections except Property Tax and VAT objections.

OBJ-002 – Objection Form For Property Tax Assessments: To be used for Property Tax objections.

OBJ-003: Objection Form For Value Added Tax Assessments: To be used for VAT objections.

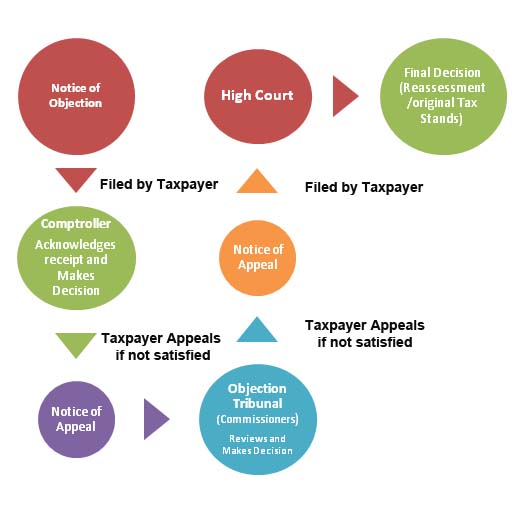

Summary of the Steps

What information do I need to provide when objecting to an assessment?

• The taxpayer's name

• Account or taxpayer’s number

• Taxation statute under which the assessment or disallowance was issued

• Date and number of the assessment

• Tax Period or transaction in question

• Amount of tax or refund, and

• Description of issue(s)

• Facts and reasons for objection

• Any other additional factual information to support your objection.

What does it cost to file the Notice of Objection?

There is no fee to file a Notice of Objection. However for a Value Added Tax (VAT) objection, the Value Added Tax Act No. 3 of 2010, Section 64 (4) states:

“(4) An objection to an appealable decision shall be

(a) in such form as may be prescribed by the Comptroller;

(b) specify in details the grounds upon which it is made, and

(c) be accompanied by payment of all tax not in dispute and 50% of the amount of tax in dispute”.

Do I have to file the notice of objection within a specified time frame?

Can I obtain additional time to file my Notice of Objection?

If you have a good reason for requiring more than 30 days to file a Notice of Objection, you can apply to the Comptroller of the Inland Revenue Department for an extension of time, before the 30 days for objections have expired. Extensions are not given for reasons such as vacation, inventory-taking or year-end timing. However, if you apply after the 30-day period for objections, you must be able to demonstrate that it was impossible to file within the 30-day period and that the Notice of Objection was filed as soon as circumstances permitted. If the explanation provided is not satisfactory, no extension of time will be granted, and your Notice of Objection will be considered invalid.

Do I have to pay the amount assessed that is in dispute while the objection is under review?

Taxpayers who successfully object or appeal will be paid interest on any amounts paid on an assessment, from the dates the payments were made. However, the amount refunded, including interest, will first go to reducing other tax liabilities owed to IRD before any refund is made.

Tax Administration and Procedures Act 2003 – 12, Section 19 (1 and 2)

Can any of the tax or interest assessed be forgiven since I don’t have the money to pay it?

There are no provisions in the Income Tax Act Cap 20.22, tax statutes to allow for the reduction of the tax or interest that has been assessed because of the taxpayer’s inability to pay. The Appeals Officer can only recommend a variance to the tax or penalty that has been assessed if it is his or her opinion that the amount assessed is an error due to an incorrect application of the law.

However, under the Property Tax Act, 2006, No. 13 of 2006 the Minister may perform a Remission of taxes (Section 65) or a Deferral of tax (Section 66) if a taxpayer is experiencing hardship or injustice has resulted or is likely to result.

Will I be compensated for my costs if I win the objection?

No compensation for costs is granted to a taxpayer who may obtain a favourable resolution at the Notice of Objection stage. The Notice of Objection process is intended to be simple, inexpensive and easily accessible

CAN I MAKE AN ARRANGEMENT TO PAY MY TAXES?

WHAT ARE THE BENEFITS DERIVED FROM PAYING TAXES?

All taxes collected by Inland Revenue Department on behalf of the Government of St. Christopher and Nevis, are used to support the economic and social growth of the Federation.

What is a best of judgment assessment?

Can I object to a best judgment assessment?

What is a reassessment?

BUSINESS AND OCCUPATION LICENCE

Why do I need to complete another form at the Inland Revenue Department after I have completed a Business Licence Application at the Ministry of Finance?

Why is my business licence approval taking so long ?

How do I apply for a Business and Occupation Licence?

What are id's and documents are required to present to process a new Business and Occupation Licence?

Individual/partnership business licence registration:

1. To SKN government issued ids of owner or partner (valid SKN Driver Licence, valid passport, valid SKN Social Security card, National ID card);

2. A utility bill showing proof of mailing address.

Company or Registered Partnership business licence registration:

1. Two government issued ids of each registered owner or partner (valid SKN Driver Licence, valid passport, valid SKN Social Security card);

2. A utility bill showing proof of mailing address of each registered owner or partner;

3. A copy of the Certificate of Incorporation;

4. A copy of the Memorandum of Articles of Association.

LIQUOR LICENCE

How to I obtain a Liquor or Beer Licence?

How do I pay my taxes online?

What taxes and licenses can be filed and paid online?

1. Insurance Premium Tax

2. Insurance Registration Fee

3. Withholding Tax

4. Excise Tax

5. Incom Tax (Companies)

6. Value Added Tax (VAT)

7. Unincorporated Business Tax (UBT)

8. Island Enhancement Fund

9. Property Tax

10. Drivers' Licence and Vehicle Licence

11. Coastal Levy

12. Travel Tax"

Can I renew my vehicle and driver licences online?

© 2020 Inland Revenue Department St. Christopher (St. Kitts) & Nevis