Objections and Appeals

- Objections And Appeals

- Objections

- Property Tax Objection

- Property Tax Review Board (the Property Tax Act 13 of 2006)

- High Court Appeal For Property Tax

- Tax Objections and Appeals (Except Property Tax)

- Tax Review Board (Tax Administration Act 2003 Section 40 - 45)

- High Court Appeal For Tax (Except Property Tax)

- Frequently Asked Questions

The Objections and Appeals function serves as the administrative forum for any taxpayer contesting an Inland Revenue Department compliance action. This is an independent function within Inland Revenue Department. Objection considers cases from all of the IRD’s Operating Divisions. Dispute resolution is the major role of the Objections and Appeals Unit. Many factors are considered in reaching that goal. In every dispute, the Objections and Appeal Section considers the applicable legal and procedural requirements as they apply to the taxpayer’s circumstances, evidence, and testimony. The Unit looks to both the law and the facts of a case, to determine an appropriate resolution to a tax dispute.

The main organizational structure is designed to continuously improve operations, employee satisfaction and customer service. The goal is that all taxpayers will get their disputes resolved within a specific time.

Our mission in the Objections and Appeals Unit of the Inland Revenue Department is to resolve tax controversies without litigation, fairly and impartially, in order to enhance voluntary compliance. The Objections and Appeals Unit aims to expedite the settlement of tax disputes without formal trial. We offer what is critical to both the Inland Revenue Department and the tax-paying public – a strong commitment of getting to the right answer, balancing both the Government’s need for an efficient tax system, and the taxpayer’s right to be treated fairly within the law.

An objection is the process by which a taxpayer can voice their disapproval and challenge a tax assessment. There are guidelines to this process, and an individual cannot object because they “believe” an assessment is incorrect. A taxpayer can object only if the bill or assessment is incorrect, and can provide information to the Inland Revenue Department that it is incorrect. Objections take time and resources in gathering, processing and verifying additional data, and the Department would like to be as efficient as possible in utilizing scarce resources.

Section 45 of the Tax Administration and Procedures Act 2003 states:

Where a request for administrative review of an assessment is filed, or where a taxpayer appeals to the Commissioners against an assessment, the tax liability shall remain due and payable, unless the Comptroller grants extension of time under section 19.

This means that the tax is due and payable even if the decision is under review. The Comptroller can grant an extension to file tax returns or receive payments.

There are two objection paths. The first is designed specifically for Property Tax, as stated in the Property Tax Act 2007, the other encompasses all of the other tax types which is outlined in the Tax Administration and Procedures Act 2003.

A taxpayer can only object to the value that was placed on the property, by the Inland Revenue Department. They cannot object to the tax. If the value is correct, then the tax is correct.

As stated in the Property Section of the website, you have thirty 30 days to object to the valuation of your property, if you believe it has been over or undervalued. After that period, the valuation is permanent until the next valuation period. Once the objection has been received the Department has 45 days to reply to the objection. For more information on how property is valued, look in the Valuation of Property section of the Property Tax tab.

To start the objection process you must complete the Objections Form (OBJ-002 – Objection Form For Property Tax Assessments). In it, you must record your name, address, contact information, the property information and define the reasons under which you are objecting. You may also include any other information that you think is relevant to your case. You should complete the form in its entirety to ensure faster service. The objections letter is sent to the Secretary of the Property Tax Review Board in care of the Inland Revenue Department.

The makeup of the board is specified in (Section 80 – 96 ) the Property Tax Act 13 of 2006. It consists of five (5) members:

80.(1). There is hereby established a Valuation Review Board consisting of at least five members appointed by the Minister.”

“80.(2). The Minister shall endeavour to appoint one or more persons who have knowledge of real estate or real estate law, such as a lawyer, real estate agent, judge or magistrate.

“80.(5). The Minister may appoint a person who is eligible to be a member to act in place of a member who is absent.”

“81.(1). The Minister shall designate the Chairperson of the Board.”

“84. A majority of the members of the Board constitutes a quorum.”

“85. A decision of a majority of the members of the Board is the decision of the Board.”

The Property Review Board has many powers including the right to have persons testify if the need arises.

“90.(1) When, in the opinion of the Board or the Chairperson –

(a) the attendance of a person to give evidence is required; or

(b) the production of a document or thing is required, the Board or the Chairperson may cause a notice to attend or a notice to attend and produce a document or thing to be served on the person in any manner in which a subpoena may be served in accordance with the Eastern Caribbean Supreme Court Civil Procedure Rules 2000 or any other law.

The Board will set a date and time for the hearing of your case. If you fail to attend the session, the hearing may proceed without you. After reviewing the facts of the case, the Review Board has the power to raise or lower the value assigned to the property. The Board must make a decision within forty-five days, unless otherwise granted an extension by the Minister.

Should the taxpayer disagree with the decision of the Review Board, they have the right to appeal its decision. This appeal must be made to the High Court (Property Tax Act Section 97 – 100) which is the final arbitrator of any appeal.

“100. The decision of the High Court is final and not subject to further appeal.”

At this point the assessment is final and the taxpayer must pay the tax.

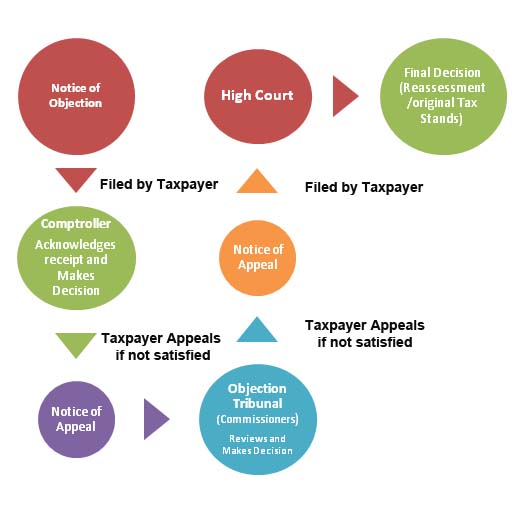

A taxpayer can only object to the assessment by the Inland Revenue Department. They cannot object to the tax. If the assessment is correct, then the tax is correct. Tax Administration and Procedures Act 2003 Section 40 – 45 lists the details of the objection process.

- (1)A taxpayer who is dissatisfied with an assessment or any other decision of the Department may request the Comptroller for an administrative review of the decision.

(2) A request for administrative review shall be made to the Comptroller in the prescribed form not later than one month from the date of the assessment or the date the taxpayer was notified of the decision.

(3) The Comptroller shall consider the taxpayer’s request and notify the tax payer in writing of his or her decision, and the reasons for the decision within a reasonable time.

Objections to assessments for Value Added Tax are guided by the provisions in The Value Added Tax Act, No. 3 of 2010, as stated in the following sections:

- (2)A person who is dissatisfied with an appealable decision may lodge an objection to the decision with the Comptroller within thirty (30) calendar days after the service of the notice of the decision.

(4) An objection to an appealable decision shall be

(a) in such form as may be prescribed by the Comptroller;

(b) specify in details the grounds upon which it is made, and

(c) be accompanied by payment of all tax not in dispute and 50% of the amount of tax in dispute”.

(6) The Comptroller may, after considering the objection, allow the objection in whole or part and amend the assessment or the decision objected to accordingly, or disallow the objection.

(7) The Comptroller shall serve on the person who is objecting a notice in writing of the decision of the Comptroller on the person’s objection.

To start the objection process, the taxpayer must complete an Objections Form (OBJ-001: Objection Form For Tax Assessments) or (OBJ-003: Objection Form For Value Added Tax). On it you must record your name, address, contact information, the assessment information and define the reasons under which you are objecting. You may also include any other information that you think is relevant to your case. You should complete the form in its entirety, to ensure faster service.

There is a minimum of three (3) commissioners appointed by the Governor General and their function is to preside over cases/decisions that have passed through the administrative review process but have been unsatisfactory to the taxpayer.

41. (1) The Governor General shall appoint Commissioners whose main function shall be to hear appeals against tax assessments but shall, in addition, perform any other functions that may be assigned to them by the Governor General from time to time.

(3) Three commissioners shall form a quorum at any meeting.

42. (2) An appeal to the Commissioners may not be made unless a request for administrative review has first been made, and a decision has been received from the Comptroller.

The decision of the Commissioners can be appealed within one month of its decision, but only on a point of law and it must be filed with the Registrar of the High Court. This appeal can be from the taxpayer, or the Comptroller.

44. (1) Either party to any proceedings before the Commissioners who is dissatisfied with the decision of the Commissioners may, within one month from the date of being notified of the decision, file a notice of appeal with the Registrar of the High Court.

How do I file a Notice of Objection?

An Objection can be filed by completing a Notice of Objection form or by writing a letter to the Comptroller of the Inland Revenue Department. The form must be signed by the taxpayer, the owner of the business or an authorized employee of the company. If a representative is appointed, the taxpayer must provide written authorization. A Notice of Objection may be sent by regular mail or facsimile transmission, or may be hand delivered to the Inland Revenue Department, Bay Road, Basseterre – Objections and Appeals section.

OBJ-001: Objection Form For Tax Assessments: To be used for all tax objections except Property Tax and VAT objections.

OBJ-002 – Objection Form For Property Tax Assessments: To be used for Property Tax objections.

OBJ-003: Objection Form For Value Added Tax Assessments: To be used for VAT objections.

Summary of the Steps

What information do I need to provide?

The Notice of Objection must include:

• the taxpayer’s name

• account or taxpayer’s number

• taxation statute under which the assessment or disallowance was issued

• date and number of the assessment

• period or transaction in question

• amount of tax or refund, and

• a clear description of each issue in dispute, fully setting out the facts and reasons for objecting to each issue

The Inland Revenue Department depends on evidence and supporting documents provided, to determine whether you will win or lose your Objection.

What does it cost to file the Notice of Objection?

There is no fee to file a Notice of Objection. However for a Value Added Tax (VAT) objection, the Value Added Tax Act No. 3 of 2010, Section 64 (4) states:

“(4) An objection to an appealable decision shall be

(a) in such form as may be prescribed by the Comptroller;

(b) specify in details the grounds upon which it is made, and

(c) be accompanied by payment of all tax not in dispute and 50% of the amount of tax in dispute”.

Do I have to file the Notice of Objection within a specified time?

According to the Income Tax Act Cap 20.22, Section 61 (1), Tax Administration and Procedures Act 2003 – 12 taxation statutes, “A Notice of Objection must be filed within 30 days from the day the Notice of Assessment, Notice of Reassessment or Statement of Disallowance was issued.”

Can I obtain additional time to file my Notice of Objection?

If you have a good reason for requiring more than 30 days to file a Notice of Objection, you can apply to the Comptroller of the Inland Revenue Department for an extension of time, before the 30 days for objections have expired. Extensions are not given for reasons such as vacation, inventory-taking or year-end timing. However, if you apply after the 30-day period for objections, you must be able to demonstrate that it was impossible to file within the 30-day period and that the Notice of Objection was filed as soon as circumstances permitted. If the explanation provided is not satisfactory, no extension of time will be granted, and your Notice of Objection will be considered invalid.

Do I have to pay the amount assessed that is in dispute while the objection is under review?

Yes, payment is required even if you have filed, or intend to file, a Notice of Objection. There are no provisions in the Income Tax Act Cap 20.22, tax statutes that allow for the suspension of payment of an amount that has been assessed, but is in dispute, pending the outcome of an Objection or Appeal.

Even though a taxpayer has lodged an objection against an assessment, or has an appeal to a decision, the tax reflected must be paid as due. (In the case of an objection to VAT assessments, payment of all of the tax not in dispute and fifty percent of the amount of tax in dispute must be paid). Payment of an assessment is not suspended by an appeal. Under the V.A.T. Act, a person can lodge an appeal to the Appeal Commissioners, and thereafter any party may lodge an appeal to the High Court and the Court of Appeal in that order.

Additional interest will be assessed on the principal liability if full payment is not received when the assessed amount is due. Taxpayers who successfully object or appeal will be paid interest on any amounts paid on an assessment, from the dates the payments were made. However, the amount refunded, including interest, will first go to reducing other tax liabilities owed to the Inland Revenue Department before any refund is made.

Tax Administration and Procedures Act 2003 – 12, Section 19 (1 and 2)

Can any of the tax or interest assessed be forgiven since I don’t have the money to pay it?

There are no provisions in the Income Tax Act Cap 20.22, tax statutes to allow for the reduction of the tax or interest that has been assessed because of the taxpayer’s inability to pay. The Appeals Officer can only recommend a variance to the tax or penalty that has been assessed if it is his or her opinion that the amount assessed is an error due to an incorrect application of the law.

However, under the Property Tax Act, 2006, No. 13 of 2006 the Minister may perform a Remission of taxes (Section 65) or a Deferral of tax (Section 66) if a taxpayer is experiencing hardship or injustice has resulted or is likely to result.

Will I be compensated for my costs if I win the objection?

No compensation for costs is granted to a taxpayer who may obtain a favourable resolution at the Notice of Objection stage. The Notice of Objection process is intended to be simple, inexpensive and easily accessible

© 2020 Inland Revenue Department St. Christopher (St. Kitts) & Nevis